Pakistan (Commonwealth Union)_ Pakistani ministers may no longer travel business class or get five-star hotel accommodations overseas during their official visits. Additionally, the government commends them for accepting salary cuts. The South Asian government trying to remain viable and avert a debt default has announced $764 million in cost-cutting initiatives necessary to help recover a $6.5 billion IMF bailout. According to Prime Minister Shehbaz Sharif, the government will impose further austerity measures in the July budget.

Following a cabinet meeting in Islamabad, he stated, “This is the need of the hour. We have to show what the time demands from us and that’s austerity, simplicity, and sacrifice.” In recent months, the fifth most populated nation in the world has come perilously close to a debt default. According to reports, the $350 billion economy has only $3 billion in foreign exchange reserves, and experiences a severe dollar shortage that threatens its external stability. According to global sources, supply interruptions triggered by flooding, food shortages, and measures taken by the government to satisfy IMF rescue requirements may further increase inflation beyond 30% for the first time in history.

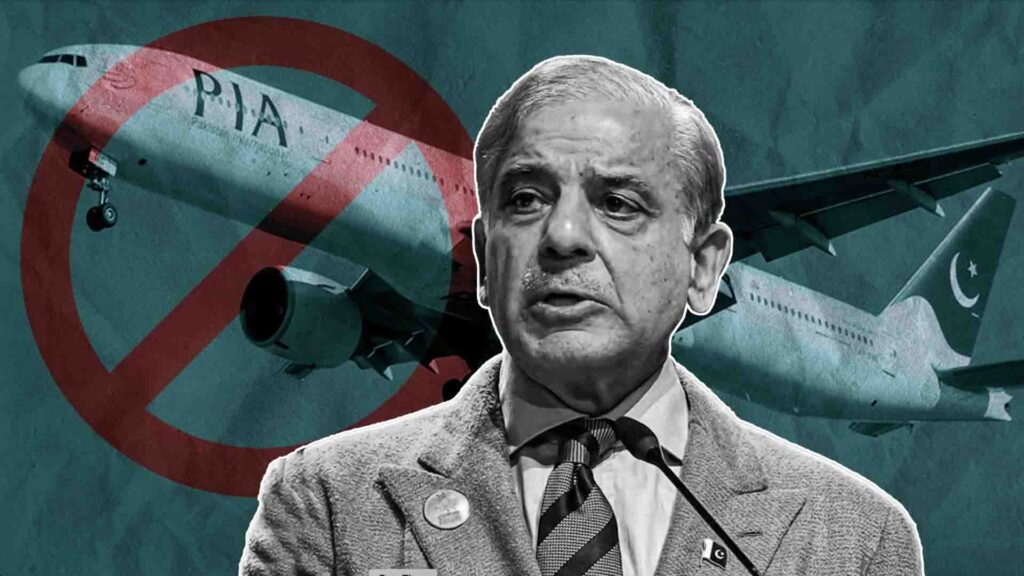

As citizens take to the streets to protest oppressive conditions, the government attempts to demonstrate that austerity begins at the highest levels. Sharif stated that other federal and state ministers, in addition to high-ranking government employees, have agreed to sacrifice salaries and other privileges. He also noted that until next year, the government has also prohibited the purchase of luxury goods and automobiles. This week, the legislature decided to implement tax hikes, including greater charges on luxury goods. After the IMF urged the nation to eliminate subsidies and allow a market-determined exchange rate, the government increased energy costs and allowed the currency to fall.

In the meantime, the State Bank of Pakistan has increased the benchmark rate by 725 basis points since the beginning of 2022, and predicted more monetary tightening in the future. On March 16, SBP will conduct its next policy review. According to reports, this year, Pakistan must return $542.5 million in coupon payments. In total, it has $8 billion in dollar bonds due by 2051, with the next $1 billion payment due in April of next year. The majority of the nation’s over $100 billion external debt comes from concessional multilateral and bilateral sources.