Europe UK (Commonwealth Union) – As Artificial Intelligence (AI) continues to transform industries across the board, it is presenting a new opportunity in the insurance sector.

An AI applied app is set to observe real-world driving conditions and accident data, together with driver and vehicle profiling, which was improved by the University of South Wales (USW) and a Cardiff-based car insurance service.

Once the system is further enhanced, the designers are planning to assist young drivers lower their expenses for motor insurance with evidence that they are safe on the roads.

Collaborating with the USW-based Centre of Excellence in Mobile and Emerging Technology (CEMET) that gives access to Welsh SMEs with funded Research & Development had Driverly Insurance form the app as part of the company mission in providing safer UK roads and at the same time rewarding good driving behaviors.

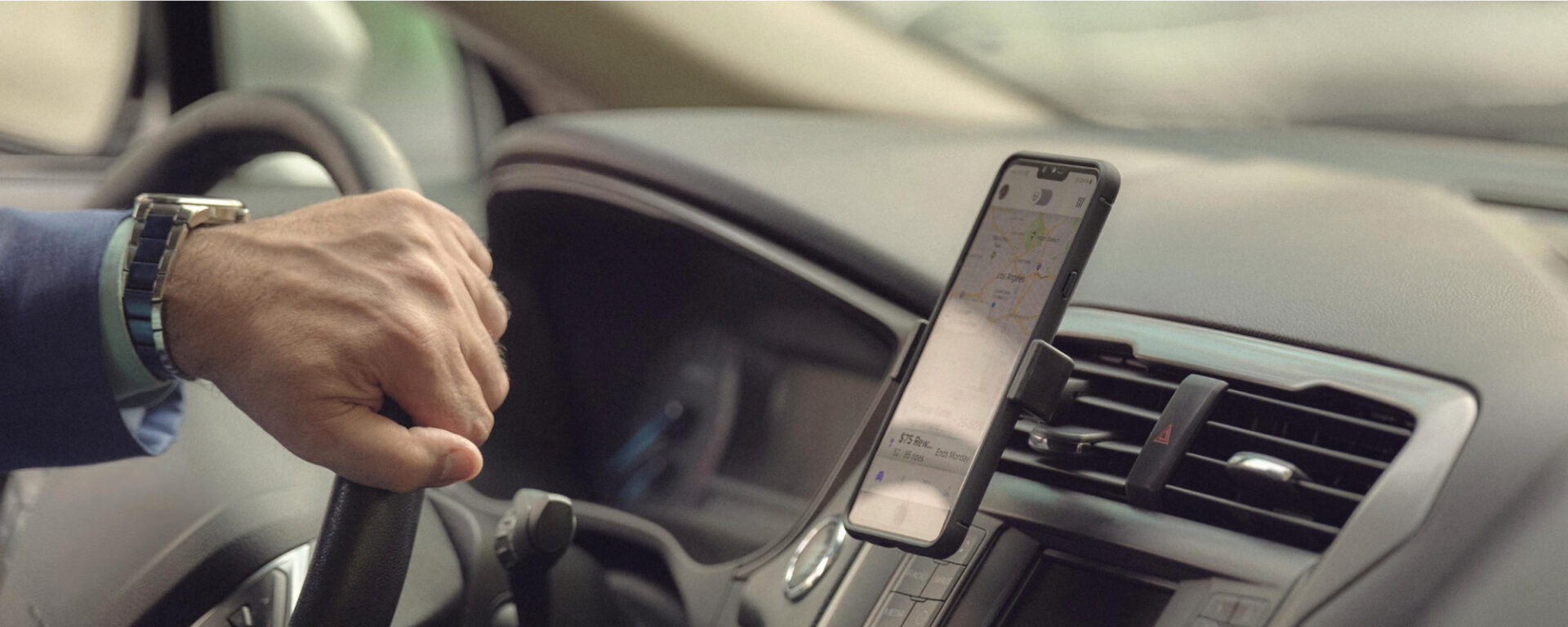

The Driverly app monitors and takes note of dozens of various driving criteria for users in forming a precise image of their driving habits, that is directly advantageous to them financially.

Following the monitoring of a person’s initial driving, Driverly has implemented more layers to its tech and providing appreciation to the specialists at CEMET. They are also recording driving behavior, where the improved app may also obtain accident profiling across all major roads in the UK, together with real-time weather forecasts producing an AI-powered image of real-world driving conditions, leading to building a risk profile with a level of detail never seen on prior occasions.

Nestor Alonso, Chief Data Officer from Driverly, who engaged closely with the CEMET experts on the development says “Having already designed and built the app, Driverly approached CEMET to take it to the next level. CEMET has added a separate layer around users’ driving context: the road conditions and the weather conditions – which has never been done before in the insurance industry with an app.”