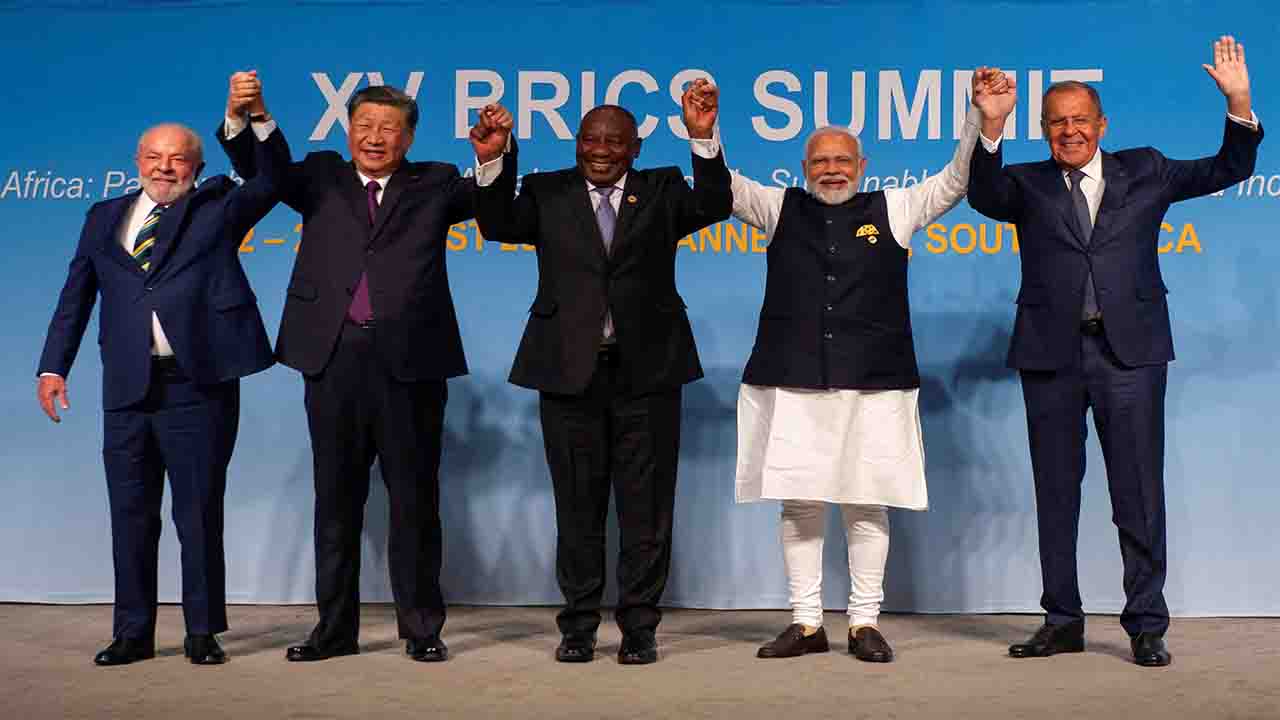

India (Commonwealth) _ The BRICS (Russia, China, India, South Africa, and Brazil) countries are causing a revolutionary change in the global financial setting. These countries are moving toward a bold strategy.

These countries want to replace the US dollar with local currencies in international commerce. Leading the way mostly from China, this initiative is gaining traction as it entices other emerging countries to join the trend. Persuading nations like Saudi Arabia, Pakistan, Russia, India, and several African countries to convert from US dollars to local currencies, such as the Chinese Yuan, for bilateral trade settlements is part of the approach.

China has had some degree of success with its persuasive strategies. The impact of this eastern behemoth spans continents and is not simply felt by its close neighbors; it is changing the face of international trade.

Concurrently, Russia, another important member of the BRICS group, is evading US sanctions by providing developing nations with cheap crude oil and demanding payments in either the Chinese Yuan or the Russian Ruble.

India is pushing for new trade deals with countries like the UAE and the Indian Rupee over the USD in international economic transactions, not wanting to fall behind. The BRICS countries have a clear overarching plan: they want to make their national currencies so strong that they can rival, if not completely replace, the US dollar’s hegemony in international commerce.

But can Russia, China, and India actually make this happen, or is it simply a pipe dream? The response is not simple. Though the concept appears workable on paper, the competitive and tumultuous internal dynamics within BRICS provide a different image.

The interaction of regional geopolitics and national interests is at the core of this intricacy. For example, India sees China’s drive for the Yuan in international transactions as a direct challenge to its financial sovereignty and a move toward Chinese financial dominance in the world economy.

Domestic political narratives frequently exacerbate these differences, which are further fueled by the historical hostility and continuing border conflicts between these two Asian giants. Moreover, these countries’ goals are not just economically motivated but also intricately linked to the dynamics of the surrounding political landscape.

Russia’s attempts to include India’s longtime adversary Pakistan in the BRICS group exacerbate the country’s unhappiness. Such actions can put pressure on the long-standing India-Russian relations and highlight the BRICS framework’s weaknesses.

The internal conflict within the BRICS is a manifestation of the long-standing desire for regional dominance and influence more than just a debate over tactics.

This discord begs the important question: Can these countries really come together to overthrow the USD given their divergent goals and mistrust of one another? The BRICS’ goal of using local currencies in place of the USD appears more like a geopolitical chess match than a single, cohesive economic strategy.

The pursuit of individual national interests and the resulting internal strife eclipse the group objective. India objects if the Yuan attempts to replace the dollar; China becomes agitated if the Rupee advances.

Due to this tug-of-war, the US dollar will continue to be the unchallenged leader of international trade for the time being. For the time being at least, the BRICS’ goal of making their national currencies the primary means of exchange is still just that—a dream. The BRICS (Brazil, Russia, India, China, and South Africa) coalition is about to launch a new currency that may compete with the US dollar in international trade.

The BRICS countries’ action represents a change in the global financial environment and is more than just an economic plan. It is also a daring geopolitical statement. By introducing this new currency, BRICS hopes to provide a compelling substitute for the US dollar, particularly for poor nations doing business internationally. Economic ramifications of the BRICS currency’s debut to the world market are anticipated to be extensive.