Australia (Commonwealth)_The RBA’s rate boost earlier this week has overshadowed a string of poor economic data from Australia and China. China’s inflation statistics in the Asian session on Friday will be critical for the AUD/USD’s near-term trend. The AUD/USD is attempting near-term resistance around 0.6710, with a break above exposing the 200-day EMA or 0.6800. So, it’s been a fascinating week for the Australian economy.

Following the RBA’s surprise hike of 25 basis points to 4.10% on Tuesday, we’ve seen a slew of poor data that may have Governor Lowe and team second-guessing their decision:

• On Wednesday, Q1 GDP came in at 0.2% q/q, a tad lower than the 0.3% projected; and later that day, China (Australia’s largest trading partner) released poor import and export numbers for May.

• In today’s Asian session, Australia announced its own poor trade balance statistic, highlighted by a 5% drop in April exports.

In the Asian session on Friday, AUD/USD traders will focus on China’s CPI and PPI inflation reports, which are likely to reveal practically stable consumer prices and an outright decrease in producer prices for the eighth straight month.

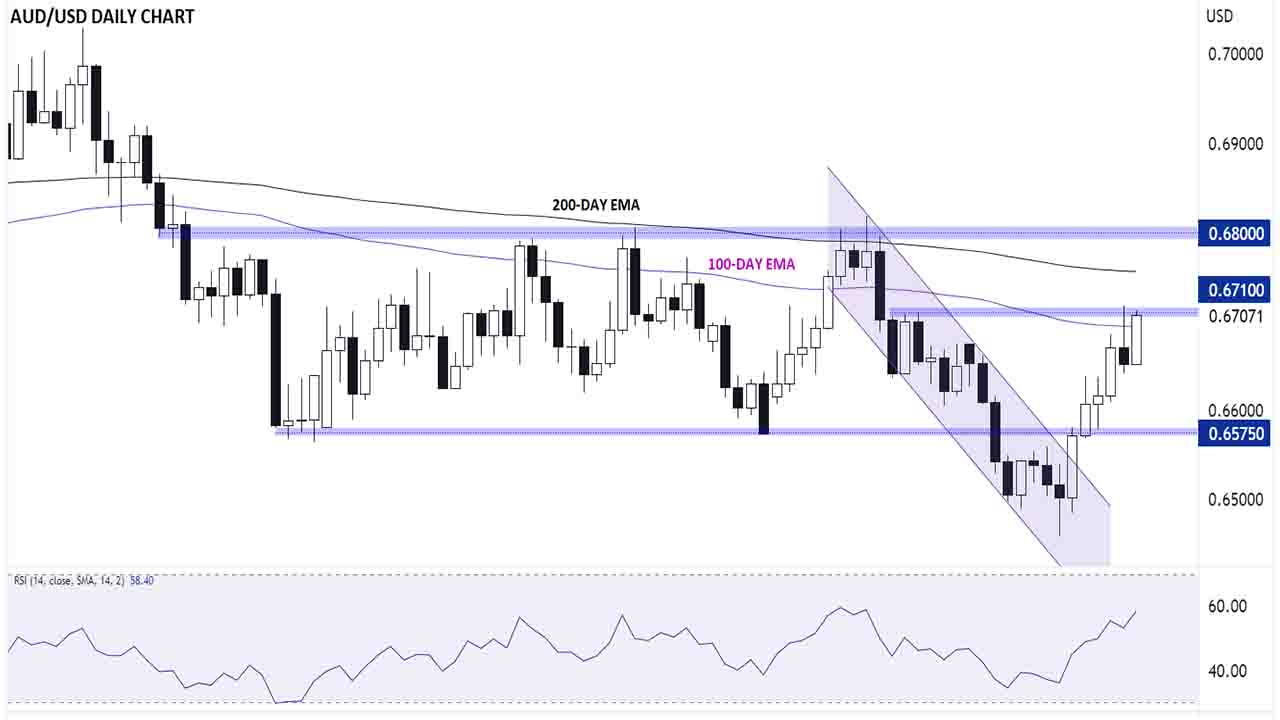

Technically, the AUD/USD has shrugged aside the gloomy mid-week data, instead focusing on the unexpected RBA rate hike as the most crucial mover for the pair. Perhaps anticipating a hawkish central bank surprise, the pair broke out of its bearish pattern late last week, and rates are currently on course to rise for the fifth day in a row, gaining more than 200 pips in the process.

As we go to press, the AUD/USD is testing a critical short-term resistance level at 0.6710, the pair’s highest level in a month. If bulls can keep the momentum going and push rates over that level, we might see a move for the 200-day EMA at 0.6760 or the 3-month highs above 0.6800. Even a short-term decline toward 0.6600 would not definitely shift the bias back in favor of the bears, as major prior support in the 0.6575 region remains in place.