UK (Common Wealth) _ According to Catherine Mann, the Bank of England’s (BoE) chief policymaker, Britain has a more serious inflation problem than the US or the euro zone.

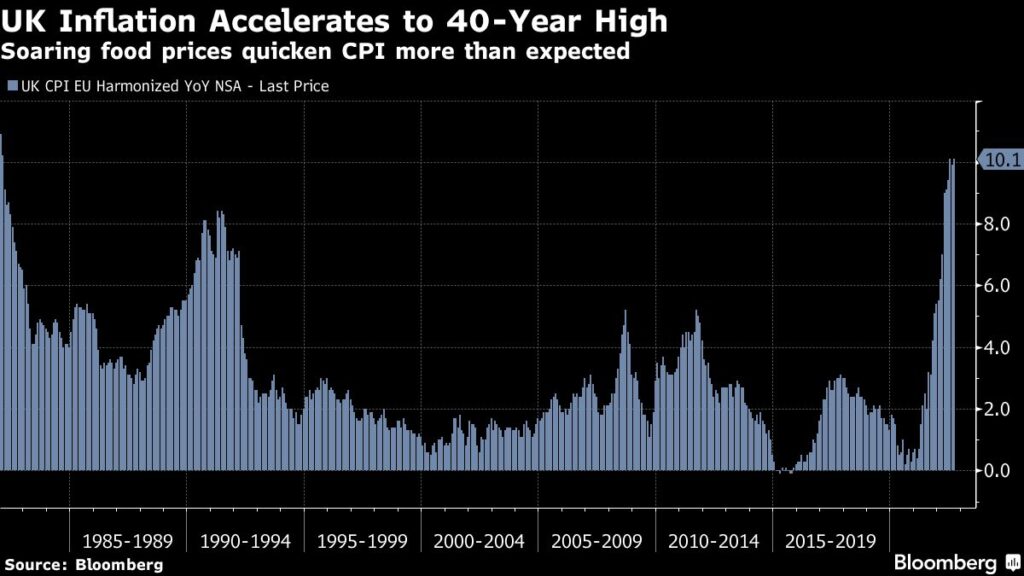

Consumer price inflation in Britain hit a 41-year high of 11.1% in October, and in April it was 8.7%, tied with Italy as the highest rate among the major advanced nations. Bond prices fell as a result of this worrying pattern since investors expected the BoE to raise rates further. The core inflation, which is a better predictor of future inflation patterns because it does not include volatile food and energy prices,

Mann emphasized that a number of variables, including the capacity of firms to pass on price increases and wage increases, are maintaining core inflation in Britain. In addition, compared to other nations, the headline inflation rate has taken longer to drop below the core rate.

British people have been able to accept price increases from businesses thanks to remaining savings from the COVID-19 pandemic. Additionally, the 9.7% raise in the minimum wage in April may have had cascading impacts on wages at higher pay levels, according to Mann.

Following last week’s stronger-than-expected inflation figures, the BoE is anticipated to hike rates to 5.5% later this year after raising them 12 times since December 2021, bringing them to 4.5% this month. Governor Andrew Bailey of the BoE and others High-ranking officials have reaffirmed their intention to act if there are signs of consistently high inflation pressures.

The impacts of Russia’s invasion of Ukraine as well as the COVID-19 epidemic have severely impacted both the UK and the EU.

The COVID-19 epidemic generated labor shortages in most major economies, yet the UK still has around 400,000 more unemployed people than it did in December 2019.

This is because of two things, according to German Marshall Fund economist Jacob Kirkegaard.

“Inequality in regional income levels is fairly severe throughout the UK. Since London is more expensive than the majority of the country, it can be challenging for people to relocate locations where there is more economic activity,” he said.

Britain’s high rate of energy inflation demonstrates the country’s excessive reliance on gas for residential heating. Additionally, it displays how poorly energy-efficient its housing stock is. However, not everyone agrees that energy prices are the primary cause of the UK’s inflation rate.

“Today’s natural gas costs in Europe are not as high. While it is true that UK gas prices increased more than those in many other European nations, they also ought to have decreased more recently, they claimed.

The fact that the total level of inflation has not decreased nearly as much as it has in the rest of the EU as a result of the drop in energy costs suggests, in my opinion that the most pressing problems facing the world today the bigger issues today are not on gas, but in other parts of the UK economy,” he said..

Luxembourg has the lowest rate at 2.7%, followed by Belgium at 3.3%, Cyprus and Spain at both 3.8%, and Luxembourg at 2.7%. However, several EU nations are doing worse than the UK. Hungary has the highest inflation rate at 25.6%, followed by the Czech Republic at 16.5% and Poland at 15.2%.

Rather than the 3.9 percent predicted back in February, the Bank of England now anticipates that inflation will decline to 5.1% by the end of the year.